Reardon vs. Mouch

March 2025

What a time to be alive. The shifts in international geopolitics, macroeconomics, and domestic institutions are unfolding at an unprecedented pace—at least compared to the past couple of decades. Now, nearly 60 days into the Trump administration, we’re starting to see the first real reactions to its policies, making it crucial to take note. Major markets are working to digest new information, while the playing field continues to shift daily, broadening the range of possible outcomes. In this note, we’ll examine the evolving geopolitical and macroeconomic landscape and consider what impact they may have on our local real estate market.

The Skim:

-

Nostalgic for 2008

-

Demand: Plugging Along

-

Supply: Building

Nostalgic for 2008

After watching the equity market volatility over the past week, I’ve found myself— strangely— nostalgic for the Great Financial Crisis. Not because it was a good time, but because at least the chaos was contained to the financial sector (system). Back then, rules were being written, deleted, and rewritten daily, and while it was stressful, we weren’t simultaneously navigating tectonic shifts in global power dynamics.

The world felt more predictable. NATO was NATO, NAFTA was NAFTA, and the government had options. We might have disagreed with our allies on how to recover from the GFC, but ultimately, rising tides lifted all boats. While the U.S. arguably carried more than its fair share of global security costs, there was an implicit understanding that the benefits of having the world’s reserve currency outweighed those expenses.

That dynamic has shifted dramatically in just the past 60 days.

A Changing Security Situation

President Trump pushed Europe to increase defense spending throughout his first term, but the issue was largely overshadowed during the Biden administration when Russia’s unprovoked attack on Ukraine forced the U.S. into action.

America’s investment in arming and supporting Ukraine has served multiple strategic purposes:

-

Weakening Russia’s military without direct U.S. involvement – Russia faces a demographic crisis and lacks the manpower for a prolonged ground war. By enabling Ukraine’s defense, the U.S. is draining Russian resources at no cost to American lives.

-

China’s ambitions and the Russia-China alliance – If Russia and China are truly “friends without limits,” then Russian assets would likely support a Chinese invasion of Taiwan. Keeping Russia tied up in Ukraine limits its ability to aid China in the Pacific.

-

The credibility of U.S. security commitments – Like Ukraine, Taiwan exists under strategic ambiguity. If the U.S. wavers on its obligations under the Budapest Memorandum, adversaries will question our stance under the Taiwan Relations Act.

Now, however, U.S. support for Ukraine is no longer guaranteed, and Europe is forced to rearm. The EU must now more heavily consider a potential outcome that Russia could win the war (now or in the future), and its forces would be on Poland’s doorstep. A terrifying scenario given Europe’s history and that urgency is evident—the EU just committed nearly a trillion dollars to defense spending.

So, it seems the administration’s goal of forcing Europe into action worked, and the US taxpayer should benefit. We won’t have to carry as big a load if Europe is spending money to defend itself, and we can use that money for domestic purposes.

A Changing Trade Environment

Trade policy, much like security policy, is a delicate balancing act between economic efficiency and national priorities. The North American Free Trade Agreement (NAFTA)—later replaced by the U.S.-Mexico-Canada Agreement (USMCA)—helped integrate North America into a seamless trade bloc, reducing costs for businesses and consumers alike. But while these agreements fostered economic growth and lower prices, they also contributed to the offshoring of U.S. manufacturing jobs, particularly in the auto and industrial sectors.

For decades, the U.S. largely accepted these trade-offs. Lower production costs meant cheaper consumer goods, and in an increasingly globalized world, access to foreign markets was seen as a net benefit. But as global supply chains have become more fragile and competition with China has intensified, trade policy has shifted toward economic nationalism—a push to bring more manufacturing back to U.S. soil.

The challenge is that rebuilding domestic manufacturing capacity takes time. Production facilities require billions in capital investment, supply chains need to be realigned, and a skilled workforce must be developed. Even with government incentives, these transitions can take years, meaning that in the short term, the result is higher prices for consumers as businesses adjust.

The Uncertainty of Tariff Policy

This is where tariff policy plays a critical role—not just in trade strategy but in business planning. While tariffs can be an effective tool for protecting domestic industries and negotiating trade agreements, uncertainty around their implementation creates a separate economic risk. Businesses plan investments years in advance, and sudden shifts in trade policy force costly adjustments. If tariffs rise and fall unpredictably, companies face difficult choices: absorb the higher costs, pass them on to consumers, or pull back on expansion plans.

For industries where a 10-30% cost swing determines profitability, this uncertainty can be just as damaging as the tariffs themselves. At this point, whether tariffs remain or are removed is less important than having a clear and stable policy. Businesses can adapt to higher costs if they know what to expect, but they struggle when the rules keep changing.

What This Means for Inflation and Interest Rates

If the current administration continues with a mix of tariffs (higher prices) and tax cuts (stimulating demand), inflationary pressure will persist. The Federal Reserve is unlikely to ease interest rates significantly under those conditions, meaning borrowing costs for businesses and consumers will remain high.

With rates recently dipping about 0.5%, this could be an opportunity for homebuyers to lock in lower rates before another shift occurs. If employment remains stable, today’s rate environment may offer a short window for long-term investment before economic uncertainty resurfaces.

Demand: Plugging Along

Supply: Building

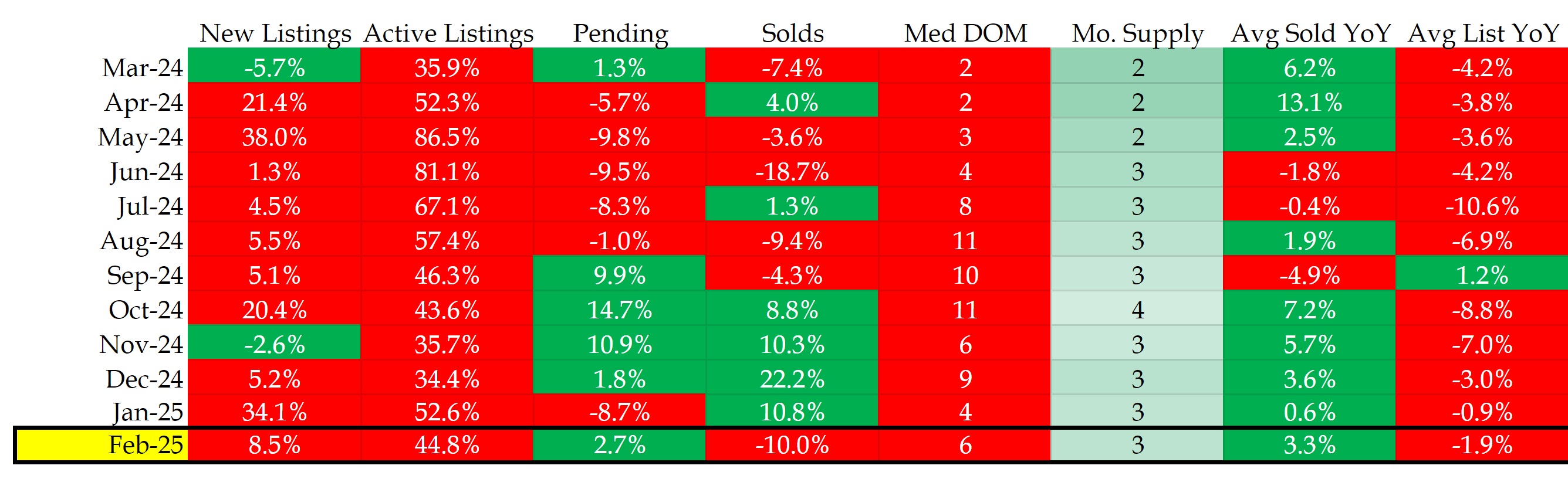

Let’s check in on our trusty table summarizing the market conditions summarizing the market conditions in the Denver metro area:

All data taken from REColorado on March 11, 2025

The word for the Front Range residential real estate market right now is “constructive.” While February’s 44% year-over-year increase in active listings marks the second consecutive month above the 40% threshold, this is less about oversupply and more about normalization. The extreme inventory shortages of the COVID boom are in the rearview mirror, and what we’re seeing now is a healthier, more sustainable market that offers buyers more options without dramatically shifting the balance of power.

Median Days on Market (DOM) sits at 25 days, well below the 120-day threshold that typically signals a slowing market. This suggests that while properties are taking longer to sell compared to the frenzy of 2021 and early 2022, demand remains strong enough to prevent any major slowdown. Prices are holding steady, with the average sales price up 3% year-over-year, reflecting the resilience of home values even as the broader economy faces uncertainty. At the current pace, we project three months of supply—a level that still favors sellers but offers buyers more breathing room than in recent years.

The demand side is picking up as well. Median DOM fell from 39 days in January to 25 days in February, a nearly two-week improvement in just a month. Detached single-family homes are moving even faster, with a median DOM of just 13 days as of early March. This decline suggests that buyer activity is starting to ramp up ahead of the critical spring and summer months, a period that traditionally sees the highest transaction volumes.

Rates and Affordability: A Window of Opportunity?

Despite broader concerns about inflation and rate pressure, mortgage rates have eased slightly, providing a near-term tailwind for buyers who have been hesitant to enter the market. Market volatility and geopolitical uncertainty, including ongoing tensions in Europe and China’s economic slowdown, have driven rates down at least 50 basis points across most mortgage products, offering buyers a chance to secure financing at more favorable terms than just a few months ago. (Rates below are priced using our affiliate pricing rates at Blue Pebble Loans.)

-

As of March 11, 30-year fixed conventional mortgages are sitting below 6.5%, an improvement from the mid-to-high 6% range seen throughout late 2023.

-

FHA 30-year fixed rates have dropped to the mid-5% range, making government-backed financing an increasingly attractive option for first-time homebuyers and those looking for lower down payment requirements.

Historically, when mortgage rates fall into the high 5% to low 6% range, buyer activity starts picking up—and this time should be no different. Affordability remains a challenge in many parts of the market, but as more sellers adjust to today’s pricing reality, we expect transaction volume to accelerate heading into Q2.

With the spring market ramping up, the next few months may present a window for buyers to lock in rates before any potential volatility in the second half of the year. If inflation remains sticky or economic data surprises to the upside, the Federal Reserve may be forced to hold rates higher for longer, delaying any significant relief in borrowing costs. For now, the short-term momentum is favorable, but buyers and sellers alike should remain nimble as macroeconomic conditions evolve.