We're Back! (With Chaos)

April 2025

After a short hiatus, the real estate market is back—and the timing couldn’t be better (or weirder). Between tariff reversals, a tumbling dollar, and surging bond yields, the macro environment feels like it’s trying to rewrite Econ 101 in real time. And yet, here in Denver, buyers seem unfazed. The summer market has kicked off early, inventory is stacking up, and demand is holding strong—even as affordability and volatility pull in an opposite direction. Beneath the surface, we’re seeing early signs of a rotation in product type driven by lifestyle shifts and a decade of lopsided development—and this may be the real story heading into summer. In this issue, we’re unpacking why the return of chaos on the national stage isn’t derailing local momentum just yet and what it all might mean for buyers, sellers, and policymakers alike.

The Skim:

-

What. Just. Happened...?

-

Demand: We Are Baaaaaaaack!

-

Supply: A Tale of Two Segments

What. Just. Happened...?

The headlines over the last 30-days have been dominated by tariffs again—and while these moves are often sold as a national security strategy or a way to “rebuild American manufacturing,” the real-world consequences are more complicated than the 5-10% moves we're seeing in the equity markets each day. At best, this is a blunt-force economic tool. At worst, it’s a direct tax on consumers that risks long-term damage to U.S. asset credibility.

Let’s start with capacity. The U.S. simply doesn’t make enough of the things it consumes. We don’t have the facilities or infrastructure to replace the volume of imports we rely on. The Joint Economic Committee recently outlined how decades of offshoring have hollowed out core manufacturing supply chains. Restarting those systems would take years of investment, regulation, and retraining—not to mention political will.

Meanwhile, retailers are already ringing alarm bells. A new round of Trump-era tariffs has companies applying line-item surcharges—some up to 40%—just to cover the cost of imported goods. Major chains are signaling that without price hikes, they’ll be forced to cut margins or reduce inventory. The Wall Street Journal and AP News have already covered early reactions from businesses large and small. Consumers will pay the difference. Inflation isn’t hypothetical here—it’s already creeping in through the back door.

Then there’s labor. Even if we could flip a switch and bring production stateside, we don’t have the people to staff the plants. A recent Deloitte report forecasts a 1.9 million worker shortfall in U.S. manufacturing by 2033 if training gaps aren’t closed. This isn’t just a pipeline issue—it’s cultural. The American workforce has shifted toward services and high-value-add sectors. Young workers are prioritizing flexibility, remote options, and upward mobility—not factory work. That’s not a judgment; it’s a reality.

But here’s what’s most alarming: the emerging signs of stress in U.S. financial assets. Just over a week ago, Trump reversed his most aggressive tariffs. Equities surged—the S&P climbed—and for a moment, it felt like the system was recalibrating.

But the U.S. dollar didn’t bounce.

The Dollar Index (DXY) dropped to 99.014, its lowest since April 2022, and remains down nearly 4% month-over-month (which stokes inflation even further). At the same time, the 10-year Treasury yield rose—from 3.6% back in September 2024 (when SPX was at a similar level) to 4.45% today. That divergence isn’t normal. It doesn’t signal a healthy risk-on rotation out of bonds and into stocks—it suggests that global capital is pulling away from U.S. debt altogether.

This isn’t just inflation fear—it’s confidence erosion.

And confidence, once lost, is incredibly expensive to buy back. Even before all of this noise in January, the Peter G. Peterson Foundation reports we already spend $2.6 billion in interest every day—a number that’s projected to hit $4.9 billion per day by 2035. This year, the U.S. needs to refinance approximately $8 trillion in long-term debt, and a 75-basis-point increase in average borrowing costs means another roughly $60 billion in new annual debt service will hit our budget—every single year—as a result of these market moves. The choices will become simple: raise taxes or cut spending, and this gambit doesn't seem to be working out as Trump and Bessent had hoped.

So yes, the tariffs may be rolled back. The trade war rhetoric may be cooling. But the damage, in many ways, has already been done. The bond market is telling us so. The dollar is telling us so. Confidence is leaking out of the system, and the cost of plugging it may create issues for a long time to come.

Demand: We Are Baaaaaaaack!

Supply: A Tale of Two Segments

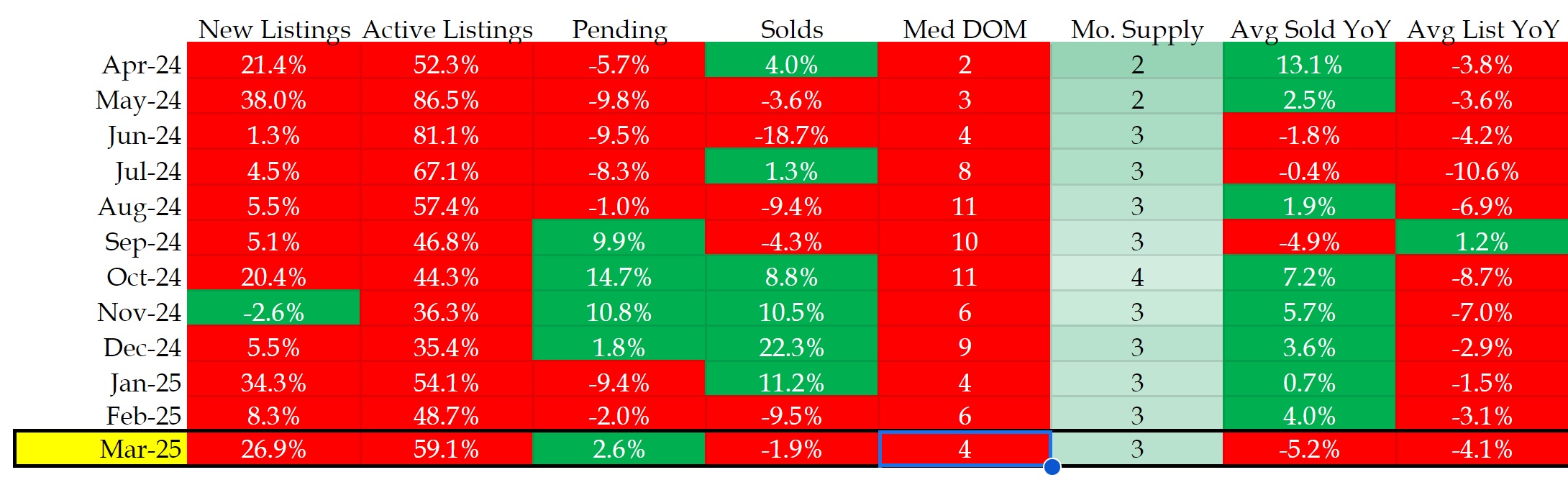

Let’s check in on our trusty table summarizing the market conditions summarizing the market conditions in the Denver metro area:

All data sourced from REColorado on April 14, 2025

March officially marked the start of Denver’s summer buying season—and it kicked off with energy.

New listings jumped 27%, pushing our active inventory up to 59% higher than this time last year. That’s a significant increase in new supply, especially considering where we were heading into Q1. But demand kept pace: pending sales rose 3% year-over-year last month, and the market responded immediately. Days on market across the metro dropped from 25 days in February to just 13 in March—a clear sign that buyers are stepping off the sidelines, even amid economic uncertainty.

That said, affordability pressures are still lingering. The average sale price declined by 5% compared to last year. While we don’t believe this signals any broader weakness in Denver’s housing market just yet, it does suggest turbulence at the top. The higher-end segment appears more sensitive to recent equity market volatility—and that sensitivity is beginning to show up in the data.

Underneath the surface, we’re seeing a clear rotation between property types. The gap between detached and attached homes persists:

-

Pending activity for detached homes rose 7% year-over-year, and median days on market fell to just 10 days. These homes are still moving fast, even up to price points just below the luxury tier.

-

Meanwhile, attached properties (condos and townhomes) saw pending sales fall 7% year-over-year, and median days on market is still higher at 19 days.

This divergence isn’t just showing up in the stats—it’s playing out across our brokerage’s listings to some extent as well. Condos and townhomes are sitting longer, while single-family homes—especially those with strong neighborhood appeal or yard space—continue to attract solid buyer interest.

We believe this trend is driven by two major forces:

-

The supply wave of attached units built over the past 5–10 years is finally hitting the market again—and there’s just more inventory to work through.

-

Younger households are aging into their next chapter without younger buyers coming up behind them. Many of the buyers we’re working with are moving from condos and townhomes into single-family homes as they grow their families or seek more permanent space.

On the flip side, we’re not seeing much demand from baby boomers downsizing into attached units. That “lock-and-leave” lifestyle isn’t fueling demand in Denver right now—at least not at the levels needed to absorb all the newer condo inventory.

Taken together, this points to a market that’s evolving—but not softening. As millennials and Gen Z households enter new life stages, we expect demand for detached homes to remain strong, while attached housing may continue to feel the weight of oversupply and shifting preferences.