Rollercoaster

February 2025

The Skim:

-

Trade Deficits Aren't Bad

-

Demand: On Trend

-

Supply: Building

Trade Deficits Aren't Bad

A trade deficit occurs when one country (the U.S.) imports more goods and services than it exports to another country (e.g., Mexico). The simple presence of a trade deficit is neither good nor bad; it merely reflects which countries are suppliers and which are consumers. As the world’s largest consumer, the U.S. will naturally run trade deficits with many countries. In fact, in 2022, we accounted for one-third of all global consumer spending.

This doesn’t mean that countries “owe” us money. Countries owe money when they borrow to fund fiscal deficits. The U.S. government spends about $6 trillion annually while receiving $4 trillion in tax receipts, resulting in a $2 trillion (fiscal) deficit funded by entities—both foreign and domestic—that purchase U.S. bonds. Confusing trade deficits with countries “owing” money is a fundamental misinterpretation of economic principles that fuels nationalistic rhetoric for the wrong reasons.

So, if trade deficits aren’t inherently negative, why does the U.S. use them to justify tariffs on our biggest trading partners? Tariffs on Canada and Mexico, for example, seem to be rooted in different concerns than those imposed on China. Under the Trump administration, tariffs on our North American neighbors are often linked to border security issues—specifically, the fight against illegal immigration and drug trafficking. The U.S. government accused Canada and Mexico of not doing enough to curb these problems and used the threat of tariffs to extract “concessions” for greater border enforcement. In exchange for avoiding a trade war, both countries pledged additional resources to secure the border. (Whether those pledges are material or additive to existing policy remains a subject of debate.) Ultimately, increasing border security is a step in the right direction, regardless of whether it was motivated by tariffs. For now, we will watch how trade relationships with our North American partners evolve.

The situation with China, however, likely stems from a different geopolitical angle. After Russia’s failure in Ukraine, it became painfully clear that China is America’s primary strategic rival for global leadership. As a result, our trading relationship with China is becoming particularly fraught. China accounts for about 20% of all U.S. imports, including nearly 50% of all manufactured goods. If tensions with China escalated—say, over Taiwan—everyone would face significant challenges. The U.S. would need to increase domestic production by 20% to replace the gap in imports, and that production would be much more expensive. This scenario would not be ideal.

Tariffs on Chinese imports are part of the broader strategy to make Chinese goods more expensive for U.S. consumers, which could help incentivize domestic manufacturing. The goal is to strengthen national security by reducing reliance on Chinese imports, but without imposing too much financial burden on U.S. consumers. This approach was easier to implement when tariffs on Canada and Mexico were also being rolled out, creating less focus on China.

Regardless of how these situations evolve, one constant is that tariffs drive inflation. This makes the current tariff strategy particularly complex, especially in light of recent inflation data, which shows core inflation ticking up to a 5% annualized rate last month (a trend further confirmed by the PPI data). Coupled with the weak retail sales data released last Friday, which signals growing stress on the American consumer, the next year or two could see some very interesting economic dynamics.

Demand: On Trend

Supply: Building

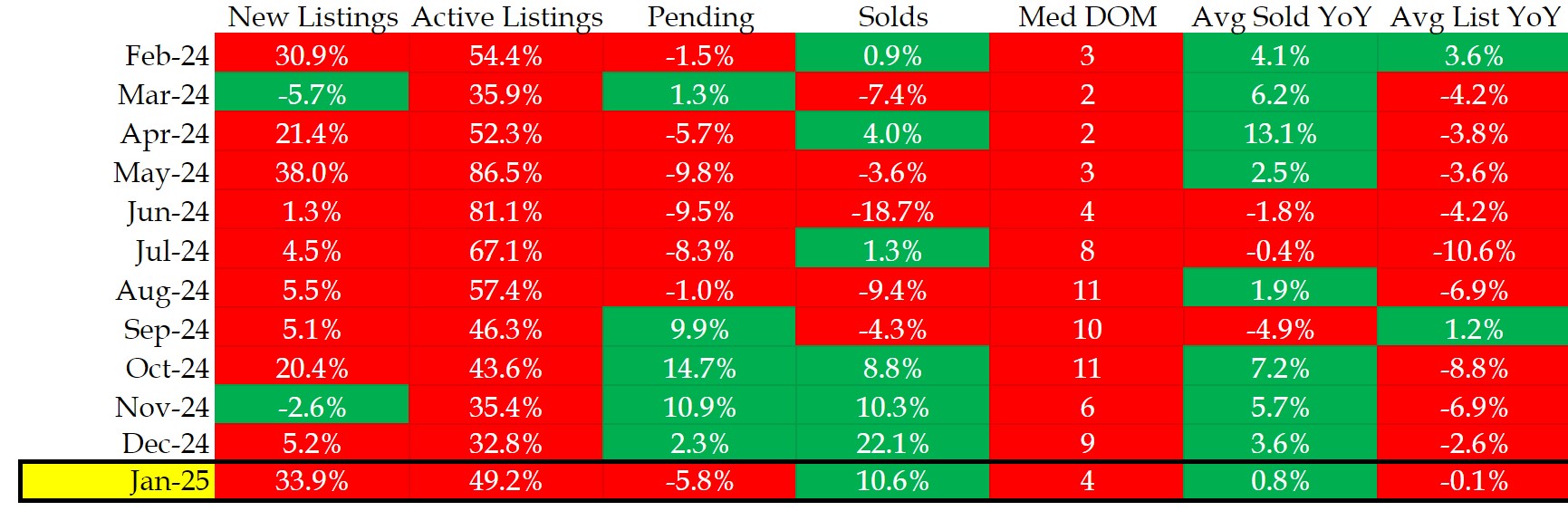

Let’s check in on our trusty table summarizing the Denver metro housing market within a 10-mile radius of downtown Denver:

All Data taken from REColorado on February 13, 2025.

It’s still a bit early to officially call the start of Denver’s summer buying season, but we’re beginning to see some early signs of activity. In 2024, we closely tracked the build-up of supply, particularly during what is typically one of the hottest periods of the year. This increase in new listings was largely expected, as many real estate brokers advise clients to list between March and May, aiming to hit the market’s upswing and sell at the highest prices of the year. However, last year, the timing didn’t work out as planned. Listings that were scheduled to hit the market during the peak season went live just as mortgage rates spiked. As a result, buyer activity decreased at various price points, leading to a market slowdown and a notable increase in supply.

It took about six months for the market to absorb these listings, and by December, we saw the lowest year-over-year increase in supply. However, things appear to have changed last month. In January 2025, new listings were up 33% compared to January 2024, translating to 400 additional units in the statistical market area. This is a significant increase for the start of the year, and while we can’t pinpoint the exact reason, the most likely explanation is that sellers who planned to list last year but held off are now trying to take advantage of being early to market in 2025.

If this is the case, it bodes well for the coming months. Typically, an increase in new listings is accompanied by a corresponding uptick in buying activity, as sellers will eventually need to secure their next homes. With homes currently sitting on the market for just over a month, it’s a good time for everyone to be transacting. While 30 days on market might seem like an eternity compared to the frantic pace of 2021 and 2022, it’s still a healthy market environment for prices. Historically, prices tend to appreciate as long as Days on Market (DOM) remains below 120 days, so we don’t anticipate sellers needing to offer significant price reductions to close a sale.

On the flip side, an increase in supply is always a positive development for buyers. It means more options and, importantly, more time to shop around and make thoughtful offers, as homes aren’t disappearing within 12 hours of listing.

Overall, the data points to another constructive spring buying season, and we expect activity to pick up over the next month or two—provided interest rates remain relatively stable.