Slowing Down

1) Mr. Powell Seems Angry

2) Rate Hikes Hitting Demand

3) Rate Hikes Hitting Supply

It’s officially the end of summer and time to get back to work. School is back in session, the leaves are starting to turn colors, and the Broncos are back to making questionable, game-ending play calls. As we were getting ready for our LDW BBQ’s, the Fed’s decision makers made some really interesting comments about their perspective on the economy and the path forward for interest rates. They told the market that "pain" is coming, and now the questions that remain are: (1) do you believe them and (2) are you ready for it?

1) Mr. Powell Seems Angry

The US Federal Reserve has a dual mandate to maximize employment levels while minimizing inflation. Unlike the ECB and BoJ, the lack of a formal "inflation mandate" in the US gives enough wiggle room for action that many “Fed Watchers” make their living predicting how the Fed will act. With unemployment levels below 4% and annualized inflation north of 8%, however, it’s no surprise the Fed is much more focused on stopping inflation at the moment.

In fact, Jerome Powell, the Chair of the Federal Reserve even used the words “economic pain” in one of his recent statements to outline his expectations for the consequences of their projected rate increases. As someone who started reading Fed statements when Bernanke was Chair and doing everything in his power to settle markets at that time, hearing a Fed Chair use the word “pain” is something that cannot be understated. Noise from politicians like Elizabeth Warren is a bit comical because the conditions for this recession have already been created, and there is literally no policy alternative for Mrs. Warren to legislate away this slowdown without making the inflation problem worse.

Back to the inflation game… The current stakes for solving this problem are much, much higher than most people realize because of the Baby Boomers. One of the problems with aging is that miscalculations in your retirement planning become magnified because you no longer have earnings potential to make up for deficiencies. Sure, you could go back to work to try to make up the gap, but then you wouldn’t be “retired” anymore, and you are probably not going back to the same wage earning as you previously enjoyed. If the Fed loses control of inflation, all of the purchasing power in Boomer savings goes away, and the government (read: Gen X, Millennial, and Gen Y) will be forced to pay for a whole generation’s retirement. For this reason, inflation *must* be stopped which increases the likelihood that the Fed will over-tighten.

The problem with over-tightening, however, is that the US government is still running at a $1 trillion annual deficit, and increasing interest rates will increase the cost of servicing our debt. (Don’t blame the Fed for this, though, because if they don’t do anything and inflation gets out of control, the countries who hold US debt will start charging more in a much, much more disorganized way…) Increased costs from servicing our debt only increase deficits with the absence of entitlement cuts. Additionally, the Federal government is adding fuel to the inflationary fire and just authorized a further $300 billion handout in the form of student loan forgiveness that will force the Fed to take even greater action.

It’s been called a game of kicking the can down the road since 2008 when the US chose to initiate quantitative easing instead of addressing its debt and entitlement problems like Europe. Until the US addresses these major issues, it’s really hard to be constructive on the macroeconomic picture.

2) Rate Hikes Hitting Demand

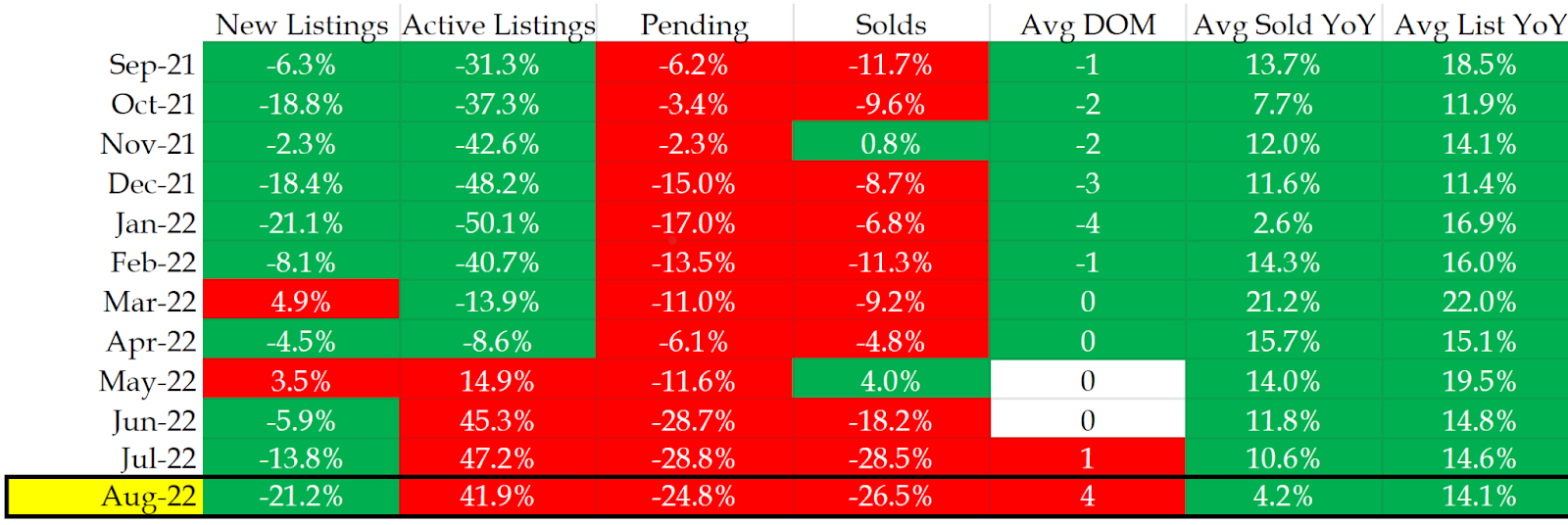

Let’s check in on our trust table summarizing the high-level statistics for the market within a 10-mile radius of Union Station in downtown Denver. All statistics are based on data taken from REColorado between September 10-13, 2022.

There are a few interesting trends to point out, and it’s pretty clear now that the broad market shift started in May. On the demand side, higher rates have impacted our market by slowing the pace of sales and starting in June, “pending” activity (or the number of units put under contract in the month) slowed down. There were actually more listings on the market at that time vs. the year prior, so the change in absorption can be directly attributed to the increase in mortgage rates.

With a 10% downpayment, the median residential unit in our market area ($712,000) cost a buyer $3,400 per month in March or April; in order to qualify for this loan, the buyer would need to make approximately $116,500 per year without any allowance for car payments, student loan payments, or other debt services. Without any change in housing prices, the increase in rates from the spring to now would increase the cost of that home to $4,500 / month and that buyer would need to make at least $154,000 to qualify. (We've discussed this previously.)

Now, prices and days on market (DOM) are adjusting to the higher rate environment, and the question becomes: how far will this correction go? The price of an average sold unit is down 13% from June which is approximately 8% more than historical seasonal behavior would suggest. (June is always the peak in our market, and we do expect prices to come down about 5% from June to August.) The problem is that they probably haven’t adjusted all the way, yet. The average price of a sold unit is now $622,000 which makes the cost of carrying that unit $4,000/mo at prevailing interest rates. If you’re like me and don’t expect that there was much *wiggle room* in the market’s ability to service debt before the rate increases, then either prices are still a bit too high or the pace of the market is still a little too fast. The average price of a sold unit would need to go down approximately another 10% for the cash cost of that unit to be constant before or after the rate increase.

3) Rate Hikes Hitting Supply

One of the secondary effects of increasing rates is that supply is actually going down right now. Not everyone is a first-time home buyer, and many transactions are dependent on someone selling a property in order to purchase another one. With the increase in prices and rates, however, we are seeing a situation in which people who want to trade (move up, down, etc.) are unable to because they wouldn’t be able to afford to reset their mortgage at higher rates. Here’s a quick example… Let’s say your family is making $100,000 / year and that allowed you to afford our median home last year. The problem is that the cost of that home has increased 10 or 20% from where it was when you bought it, and you wouldn’t be able to afford that house now. So, if you want to take the equity from your current home and use it to trade up, you can’t unless you are making substantially more money (debt service coverage) or want to put fresh equity (higher downpayment) into the deal. As a result, many “normal” deals that would happen because of changes in situations, life, etc. are not happening in the same way they would have only a few months ago.

One of the most important lessons learned from my front-row seat of the 2008 Financial Crisis was that our financial system is way too complicated for any single person to understand all of it, and effects take much, much longer to work their way through the system. At the end of the day, we’re approximately 6-months removed from the *first* rate hike hitting the system, and that means we haven’t felt the full effects with the Fed suggesting more is coming down the pipeline. It’s our opinion that this is a time to stay relatively conservative on the risk curve – residential, main & main, fixed-rate financing. Everything will be fine.